SABRE GOLD – 23% Mineral Resource Increase to Gold Ounces At Copperstone, Arizona

TORONTO, ONTARIO – September 21, 2021 – Sabre Gold Mines Corp. (TSX: SGLD, OTCQB: SGLDF) (“Sabre Gold” or the “Company”) is pleased to announce an updated mineral resource at its 100%-owned Copperstone gold project located in Arizona, United States.

Highlights:

- 23% increase in gold ounces in all categories;

- 53% increase in Measured Resources to 196,000 gold ounces at 7.6 g/t;

- 45% increase in Inferred Resources to 212,000 gold ounces at 5.9 g/t;

- The resource was estimated at a gold price of $1,700 ounce with a modest reduction of 9,700 ounces when calculated at a gold price of $1,600 ounce;

- Underground mapping and sampling confirm that the mineralized domains occur where previously modelled;

- Drilling continued to demonstrate continuity in mineralization within mineralized domains and delimited some domain edges where step out holes were drilled; and,

- Capping of very high grade intercepts were distinct for each mineralized domain and based on conservative detailed statistical analysis which will provide potential further upside.

Giulio T. Bonifacio, CEO & President of Sabre Gold, stated: “We are pleased to release an updated mineral resource estimate for the Copperstone gold mine which has increased by 23% in all categories at an average grade of 6.6 g/t gold and 53% increase in the Measured category at 7.6 g/t gold from the previously published resource estimate. The resource update includes 152 new drill holes for 12,900 meters of additional drilling. The primary focus of drilling was to focus on classification and confirmation of the previous resource estimate. We are pleased with the further increase in the Inferred category, which will provide upside potential for future conversion. Additionally, several highly prospective expansion targets that have been recently identified remain untested.”

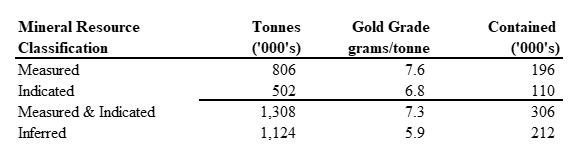

The updated mineral resource is summarized below:

Notes

(1) The effective date of the mineral resource estimate is June 16, 2021 The QP for the estimate is Mr. Richard A. Schwering, P.G., SME-RM, of Hard Rock Consulting, LLC. and is independent of Sabre Gold Mines Corp.

(2) Mineral resources are not mineral reserves and do not have demonstrated economic viability such as diluting materials and allowances for losses that may occur when material is mined or extracted; or modifying factors including but not restricted to mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. Inferred mineral resources may not be converted to mineral reserves. Inferred mineral resources are that part of a mineral resource for which the grade or quality are estimated on the basis of limited geological evidence and sampling. Inferred mineral resources do not have demonstrated economic viability and may not be converted to a mineral reserve. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

(3) The mineral resource is reported at an underground mining cut-off of 2.74 grams/tonne (0.080 oz/ton). The cut-off is based on the following assumptions: a gold price of $1,700 oz/ton, a mining cost of $68.04/tonne ($75.00/ton), a processing cost of $32.66/tonne ($36.00/ton), a G&A cost of $12.70/tonne ($14.00/ton), a 95.0% gold recovery, 3.0% gross royalties, and a refining and smelting cost of $10.00 oz/ton

(4) Rounding may result in apparent differences when summing tonnes, grade and contained metal content. Tonnage and grade measurements are in metric units unless otherwise stated. Prices are stated in US currency.

(5) The number of modelled domains increased to 48 from 42.

The updated Mineral Resource Estimate has an effective date of June 16, 2021 and was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI-43-101”) by Hard Rock Consulting, LLC, based in the U.S.A. A copy of the NI 43-101 Mineral Resource Estimate will be filed on SEDAR and on the Company’s website within 45 days.

Mr. Richard A. Schwering, P.G., SME-RM, a Resource Geologist with Hard Rock Consulting, LLC, is responsible for the Copperstone Project Mineral Resource Estimate with an effective date of June 16, 2021. Mr. Schwering is a Qualified Person as defined by NI 43-101 and is independent of Sabre Gold Mine Corp. Mr. Schwering estimated the mineral resources based on drill hole data constrained by forty-eight structurally controlled domains using an Ordinary Krige algorithm. Five-foot downhole composites were generated within the domain boundaries. Composite statistical populations were examined for outliers by domain. Eight domains with extreme outliers had those values capped. Twenty-eight domains had outliers restricted within a percentage of the variogram distance. Twelve domains did not show statistical outliers within the populations and composites were not capped or restricted. The Geologic Model and Mineral Resource Estimate were completed using Leapfrog Geo® Software version(s) 6.0.5 and 2021.1.2.

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Michael R. Smith, SME Registered Member (Geology), who is a “Qualified Person” as defined by NI 43-101 for this project.

Quality Assurance and Quality Control Statement

Procedures have been implemented to assure Quality Assurance Quality Control (QAQC) of drill hole assaying being done at an ISO Accredited assay laboratory. Drill hole samples to be assayed are securely stored for shipment, with chain of custody documentation through delivery. Mineralized commercial reference standards or blank standards are inserted approximately every 20th sample in sequence and results are assessed to ascertain acceptable limits for analytical variance. Duplicate samples will also be taken as a further check in lab precision and accuracy. All results will be analyzed for consistency and corrective actions taken, if needed.

About Sabre Gold Mines Corp.

Sabre Gold is a diversified, multi-asset near-term gold producer in North America which holds 100-per-cent ownership of both the fully permitted Copperstone gold mine located in Arizona, United States, and the Brewery Creek gold mine located in Yukon, Canada, both of which are former producers. Management intends to restart production at Copperstone followed by Brewery Creek in the near term. Sabre Gold also holds other investments and projects at varying stages of development.

Sabre Gold has approximately 1.1 million ounces gold in the Measured and Indicated categories, and approximately 1.5 million ounces gold in the Inferred category. Additionally, both Copperstone and Brewery Creek have considerable exploration upside with a combined land package of over 230 square kilometres that will be further drill tested with high-priority targets currently identified. Sabre Gold is led by an experienced team of mining professionals with backgrounds in exploration, mine building and operations.

For further information please visit the Sabre Gold Mines Corp. website (www.sabre.gold).

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking information under Canadian securities legislation including statements regarding drill results, potential mineralization, potential expansion and upgrade of mineral resources and current expectations on future exploration and development plans. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to: the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; reliance on third parties, exploration risk, failure to upgrade resources, the degree to which mineral resource and reserve estimates are reflective of actual mineral resources and reserves; the degree to which factors which would make a mineral deposit commercially viable are present, and the risks and hazards associated with underground operations and other risks involved in the mineral exploration and development industry. Risks and uncertainties about Sabre Gold’s business are more fully discussed in the Company’s disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Sabre Gold assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.